-

18 NOVEMBER

2021Silver Valley Metals Announces an Option to Acquire the Page Mine and Surrounding Prospective Landholdings in the Silver Valley, Idaho

Silver Valley Metals Announces an Option to Acquire the Page Mine and Surrounding Prospective Landholdings in the Silver Valley, Idaho

- Top ten historical producer in the Silver Valley, Coeur d’Alene District, Idaho

- Over 1 billion pounds of zinc and lead and 14.6 million ounces of silver mined to date

- In-situ high grade historical resources defined

- Consolidation of the western end of the Silver Valley’s mining corridor

- Patented claims

- No NSR

- Significant exploration opportunity

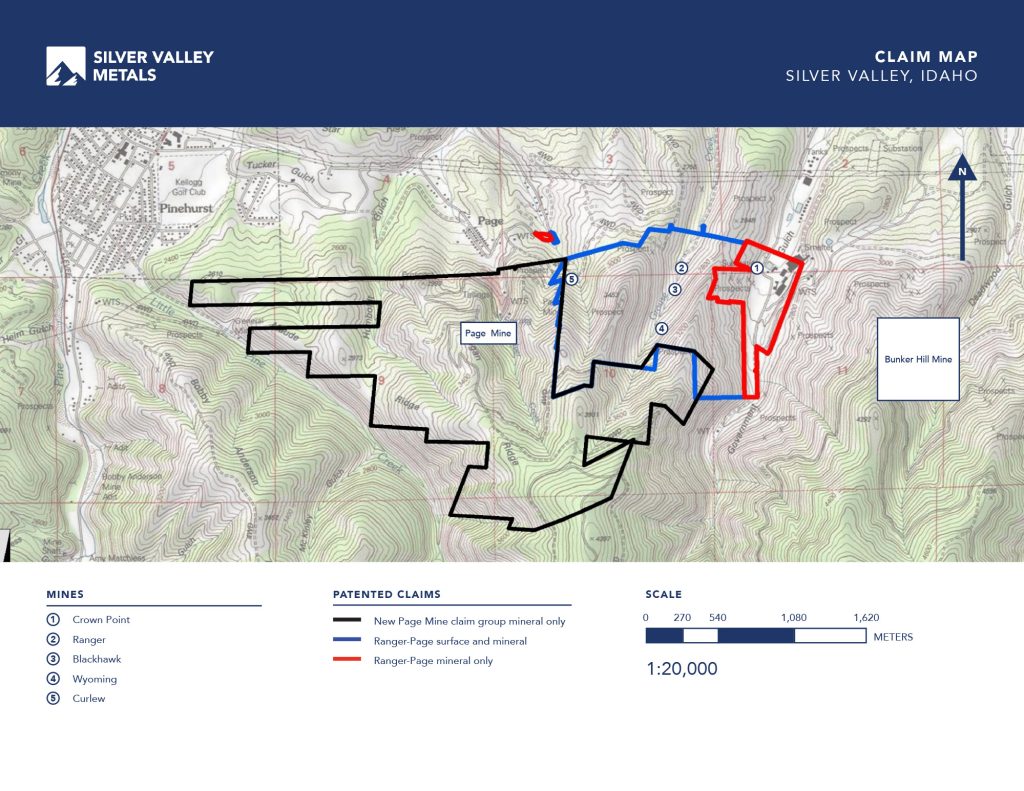

Vancouver, British Columbia – November 18, 2021 – Silver Valley Metals (“Silver Valley” or “the Company”) (TSX-V:SILV / FSE:L3U / OTC:BNRJF) is pleased to announce the signing of an option to acquire the Page Mine and specifically, the prolific Tony Vein, along with a prospective land package rich in exploration potential. The project is contiguous to the west and south of the Company’s Ranger-Page Project which consolidates for the first time under one operator the western end of the Silver Valley’s mining corridor. The Page Mine and area comprise 49 patented mining claims totaling 802 hectares located approximately 60 kilometres east of Coeur d’Alene, Idaho. The claim package triples the size of the Company’s Silver Valley project area. (see Claim Group – Western Extension)

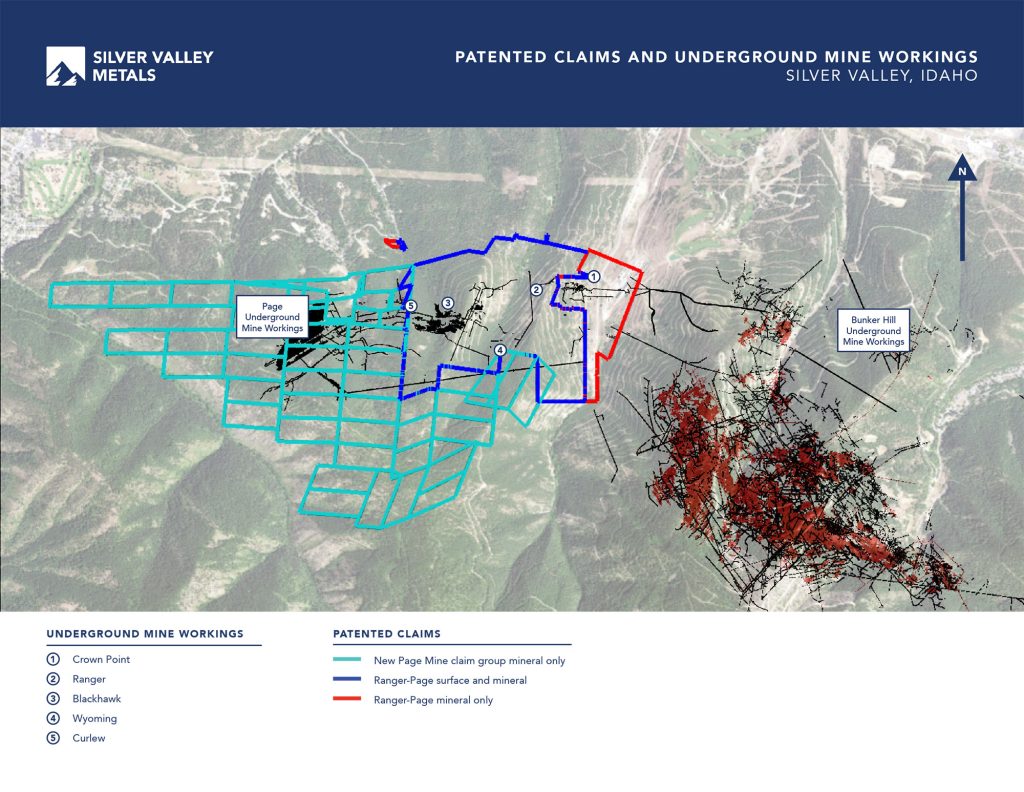

President and CEO Brandon Rook stated, “The option to acquire the Page Mine and its surrounding land package is a significant transaction for Silver Valley at this beginning stage of the Company’s growth. With this minimal dilutive transaction, the Company can apply its cash resources into exploration focusing on both projects as one. With shared underground infrastructure connecting the Page Mine with the five shallower mines on our neighbouring Ranger-Page project the Company will strategize an exploration plan that will target the nearer surface mineralization on the eastern end of the project (Crown Point, Ranger, Wyoming) with the mineralization at Blackhawk (350 metres below elevation) located in the central area of the project and westward to the deeper Tony Vein historical resources at the Page Mine. This is notwithstanding the potential of new discoveries as the entire project area has never had modern geological exploration applied to it.” (see: Patented Claims – Underground Mine Workings and Claim Map)

The Page Mine operated from 1916-1917 and from 1926 to 1969, closing because of a devastating fire and following that, was never re-opened due to the closure of the area because of the Superfund. Prior environmental issues have now been resolved and the area is once again open for exploration and mining.

Formerly owned by American Smelting & Refining Company LLC (“ASARCO”), the Tony Vein was mined to a vertical extent of 2,644 feet (3400 level). The Page Mine produced approximately 1.1 billion pounds of zinc and lead and 14.6 million ounces of silver. Page ranks as one of the top ten producers in the Coeur d’Alene Mining District. ASARCO geologists have surmised that the Tony Vein at the Page Mine was well mineralized at the 3400 level and remains open at depth.

Significant in-situ historical resources have been defined and are as follows:

| Tons | Silver (g/t) | Silver (oz) | Zinc (%) | Zinc (lbs) | Lead (%) | Lead (lbs) | Silver Equiv. (g/t)* | Silver Equiv. (oz)* | Zinc Equiv. Grade (%)* | Zinc Equiv. (lbs)* |

|---|---|---|---|---|---|---|---|---|---|---|

| 218,000 | 87.4 | 555,727 | 10.34 | 45,082,400 | 5.22 | 22,759,200 | 599 | 3,810,380 | 16.8 | 73,276,540 |

The historical resources do not constitute what is remaining in the mine but rather, defines what ASARCO outlined for next steps during mining. Mineralization in the District is very well understood to trend to great depths well beyond what has been mined at the Page thus far.

Terms of the Transaction:

Rental and option to acquire 100% of the mineral rights of the Page is as follows:

- Term: 10 years

- Year 1: $60,000 USD

- Year 2 – 10: $30,000 USD per annum

- To purchase 100% of the PATENTED mineral rights to the Page project: $1,500,000 USD

- All rental payments to be credited towards the option purchase price

- No Royalties

For additional information please visit the Company’s website at www.silvervalleymetals.com

Qualified Person

Timothy Mosey, B.Sc., M.Sc., SME, is the Qualified Person (“QP”) for the Company and qualified person as defined by National Instrument (“NI”) 43-101. Mr. Mosey supervised the preparation of the technical information in this news release.

About Silver Valley Metals Corp.

Silver Valley Metals is a brownfields exploration company focused on its flagship Ranger-Page Project located in the prolific Silver Valley of Idaho, 60 kilometres east of Coeur d’Alene and 1 kilometre from the I-90 freeway. Idaho was ranked the 9th best mining jurisdiction in the world in 2020 (Fraser Institute 2020 Annual Mining Survey). The Project is strategically located bordering two large mines, Bunker Hill to the east and Page to the west. Five historic mines are on the Project with underground mining data and surface geological data supporting high grade silver-zinc-lead mineralization present within the shallow, undeveloped mines. These mines remain open at depth, and laterally along strike, with no modern systematic exploration applied to the Project.

The Company also has a 100%-owned interest in a lithium and potassium bearing salar complex comprising 4,059 hectares on three mineral concessions (the “Mexican Projects”) located on the Central Mexican Plateau in the states of Zacatecas, and San Luis Potosi, Mexico. The NI 43-101 inferred mineral resource contains 12.3Mt of Sulfate of Potash (SOP) and 243,000 tonnes of lithium carbonate equivalent (LCE) and remains open in all directions for expansion. The Company is led by an experienced group of mining, financing, and exploration specialists.

On behalf of the Board of Directors of Silver Valley Metals,

“Brandon Rook”

Brandon Rook, President & CEO, Director

For further information please contact us at:

604-800-4710

THE TSX VENTURE EXCHANGE HAS NOT REVIEWED AND DOES NOT ACCEPT RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

The information contained herein contains “forward-looking statements” within the meaning of applicable securities legislation. Forward-looking statements relate to information that is based on assumptions of management, forecasts of future results, and estimates of amounts not yet determinable. Any statements that express predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance are not statements of historical fact and may be “forward-looking statements.” Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to differ from those reflected in the forward-looking statements, including, without limitation: risks related to failure to obtain adequate financing on a timely basis and on acceptable terms; risks related to the outcome of legal proceedings; political and regulatory risks associated with mining and exploration; risks related to the maintenance of stock exchange listings; risks related to environmental regulation and liability; the potential for delays in exploration or development activities or the completion of feasibility studies; the uncertainty of profitability; risks and uncertainties relating to the interpretation of drill results, the geology, grade and continuity of mineral deposits; risks related to the inherent uncertainty of production and cost estimates and the potential for unexpected costs and expenses; results of prefeasibility and feasibility studies, and the possibility that future exploration, development or mining results will not be consistent with the Company’s expectations; risks related to commodity price fluctuations; and other risks and uncertainties related to the Company’s prospects, properties and business detailed elsewhere in the Company’s disclosure record. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking statements. Investors are cautioned against attributing undue certainty to forward-looking statements. These forward-looking statements are made as of the date hereof and the Company does not assume any obligation to update or revise them to reflect new events or circumstances. Actual events or results could differ materially from the Company’s expectations or projections.